Guide to International Payments for Small Businesses

7 min read |

As a small business, you’re always looking for ways to keep your overheads down. So when it comes to making international payments, it’s important to find the most cost-effective and efficient way to do so. In this blog post, we’ll take you through the different types of international payments, and show you how our app can help make them faster, easier and more affordable than ever before.

What is an international payment?

An international payment involves the transfer of money between countries. This transaction serves various purposes, such as settling payments with suppliers in other countries or receiving funds from clients situated overseas.

As money is travelling across borders, it involves two different currencies being exchanged – a foreign exchange (FX). Exchange rates continuously fluctuate. This means it’s highly likely that the value of your international payment will change between one transaction and the next. So the main aim of making international payments is to minimise your exchange rate risk and keep currency losses to a minimum.

How international payments work

In the past, making an international payment could only be done through a bank or a specialist provider like Western Union. This would involve:

• Opening an account with the usual identity checks

• Getting details of where you want the international payment to end

up, including the recipient’s IBAN number which is needed to make cross-border payments through the banking network

• Filling out paperwork

• Waiting for days for the payment to be processed and sent, possibly

via multiple intermediaries, to the receiving account

International bank payments are sent through the SWIFT network, which is a cooperative of banks that manage international payments. This system was created in the 1970s and it’s still used today because it’s tried and tested, yet it’s far from perfect.

For one thing, using SWIFT can be expensive. You’ll typically be charged a fee by your bank for sending an international payment and the receiving bank may also take a cut. And then there’s the FX fee. Most banks will add a margin to the market foreign exchange rate which can be anywhere from fractions of a percent to a hefty 5% on top of the market rate. These costs quickly add up, particularly if you’re making regular international payments and it’s not always clear what the true costs are, so it may cost more than you expect.

What’s more, international payments made through SWIFT can take days to process. Some transactions are quicker than others; for example, if you’re sending euros from one account to another inside the Single Euro Payments Area (SEPA), your transaction should be processed during the same day. But even then, banks tend to process transactions in groupings at set times throughout the day, so your request will not be processed instantly. If you need to make a payment urgently, you’re often out of luck.

The better way of making international payments

There are now many specialist providers that have disrupted the international payments market with their innovative technologies and transparent pricing. These companies have developed new ways of moving money around the world quickly, easily and at a much lower cost. Here are just some of the benefits:

Faster payments

Compared to other methods of sending money abroad, international money transfers are mostly completed within a day depending on the amount you are transferring, the service you are using, and the currencies involved in the exchange. Many transactions are completed on the same day or even instantaneously.

More convenient

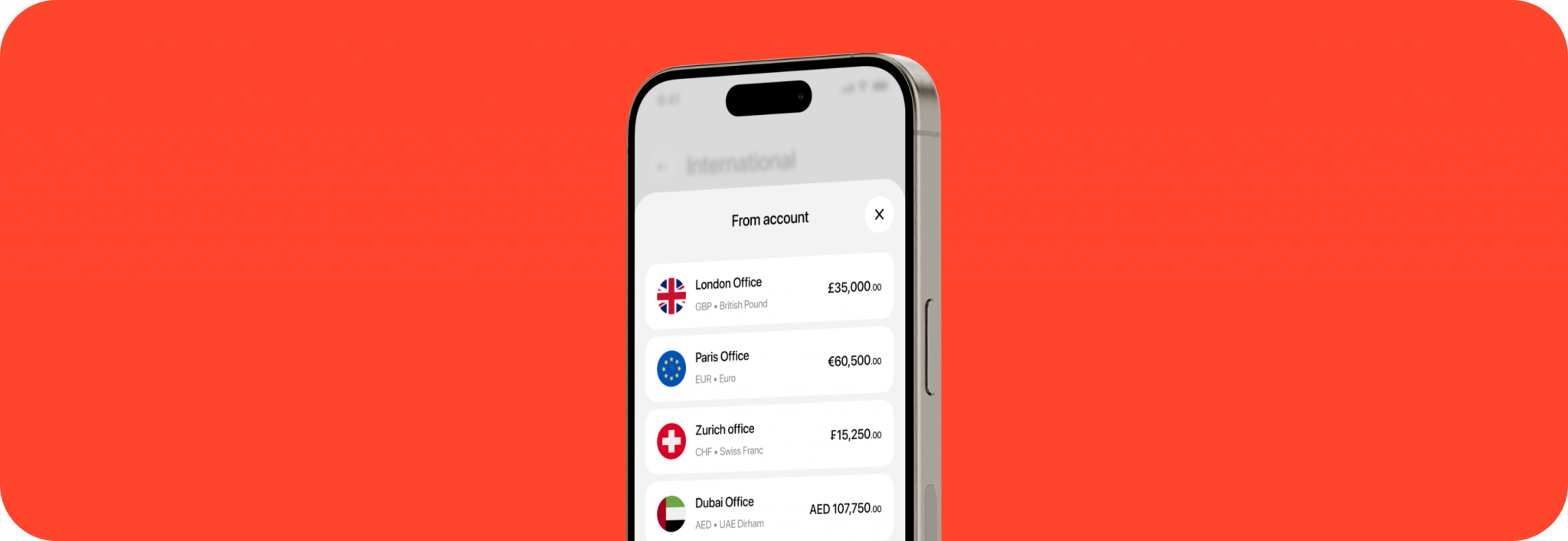

With an online payment service, you can literally send money to any part of the world all from your smartphone. Online transfers are as simple as logging into the app of your provider, filling in the necessary information, and executing the transfer. You can also manage all of your business payments, expenses, and currency accounts in one place – controlled by you, 24 hours a day, seven days a week – saving you time and money.

More transparency on the currency details

Rather than being stuck with the rates the bank charges, transferring money online gives you the freedom to choose the rate that works for you before you send money overseas. At Luminary, for example, we give you a complete breakdown of the exchange rate being applied, the amount your recipient gets in local currency and the estimated time it will take your money to reach the recipient. There are no surprises.

Cheaper

While banks invariably will charge you astronomical transfer fees, many specialist providers charge much more cost-effectively. You can transfer money to 190 countries, much cheaper than the big banks.

Fully traceable

International payments that involve the SWIFT network have excellent traceability. The network tracks the transaction so you know exactly where your money is in the system. Many online payment providers go a step further and are set up to send alerts as soon as the beneficiary has received the payment.

Now that you know how easy, fast, and cheap it is to make an international payment with Luminary, why not try it out for yourself?

Download the app now and open an account with us today.